On this page:

Change to nominating eCTs to electronic conveyancing transactions

PEXA Ltd is introducing functionality into the PEXA system from 6 November 2017 to streamline the process for nomination of electronic Certificates of Title (eCTs).

Subscribers with control of the eCT (the eCT Control) and who have signed an instrument in an electronic transaction can lodge their instruments without the need for a nomination (Administrative Notice). Land Use Victoria will accept lodgment of these transactions provided the supporting eCT has not been nominated to another lodgment case or paper instrument. For example, a nomination will be optional for a refinance transaction when ABC Bank Ltd is eCT Control and ABC Bank Ltd is signing the Discharge of Mortgage.

In all other cases, an Administrative Notice will need to be completed to nominate a supporting eCT.

Nominations are still required for all paper transactions.

Important dates for electronic and paper transactions

Customers are reminded of significant dates fast approaching:

1 December 2017

- All standalone caveats and withdrawals of caveat signed on or after 1 December 2017 must be lodged using the Electronic Lodgment Network (PEXA). This requirement applies to conveyancers and lawyers acting for a party or for themselves and PEXA subscribers.

- Non-authorised deposit-taking institutions (ADIs) standalone discharges of mortgage, standalone mortgages and refinance transactions (discharge of mortgage and mortgage) signed on or after 1 December 2017 must be lodged using the Electronic Lodgment Network (PEXA). This requirement applies to conveyancers and lawyers acting for a non-ADI and non-ADIs who are PEXA subscribers.

31 December 2017

The ‘transition period’ for accepting forms not containing certifications ends on 31 December 2017. All forms signed on or after 1 January 2018 lodged for registration must be in the new form. Where a conveyancer or lawyer represents a party in the transaction, the form must:

- be signed on behalf of the party by the conveyancer or lawyer

contain the certifications required by the Registrar’s requirements for paper conveyancing transactions.

Detailed information regarding the Registrar’s requirements for Client Authorisations and certifications is in Customer Information Bulletin 163.

Non-compliant forms will not be accepted.

Transition to 100% digital lodgment

The following sets out all the requirements and timelines for transitioning to 100% digital lodgment.

2017

November

- Survivorship functionality will be available in PEXA.

- Streamlined nomination functionality for electronic certificates of title (eCTs) in PEXA.

1 December

- Standalone caveats and withdrawals of caveat to be lodged electronically.

- Non-ADI standalone discharges of mortgage, standalone mortgages and refinance transactions are to be lodged electronically. This requirement applies to conveyancers and lawyers acting for a non-ADI and non-ADIs who are PEXA subscribers.

31 December

- Transition period for the national mortgage form (NMF), Client Authorisations and forms not containing certifications ends.

- Transmission application functionality will be available in PEXA.

- All survivorship applications and standalone transfers must be lodged electronically. This requirement applies to conveyancers and lawyers acting for a party or themselves and PEXA subscribers.

2018

February

1 March

Standalone transfers are transfers that are not lodged with some other instruments. The requirement does not include transfer types that as at 1 March 2018 are not available in PEXA such as transfers: by mortgagees, by a minor, creating an easement, of an interest (e.g. a lease or mortgage), of part of land in a folio of the Register, of a tenant in common’s share; and those transfers that cannot be assessed in Duties Online.

1 October

- All instruments or a combination of instruments available in PEXA are to be lodged electronically. Examples include a case comprising a withdrawal of caveat, discharge of mortgage, transfer and mortgage. This requirement applies to conveyancers and lawyers acting for a party or themselves and PEXA subscribers.

- All instruments to be lodged electronically. This requirement applies to conveyancers and lawyers acting for a party or themselves and PEXA subscribers.

2019

1 August

The exception will be when there is an existing paper instrument that has been signed prior to the date when electronic lodgment of that particular class of instrument or transaction is required.

Using new forms containing certifications

All customers should note the following when using the new forms:

- each item in a form should be completed before selecting the signing option

- the appropriate signing option should be selected prior to printing so the relevant certifications are displayed

- all new forms print as at least two (2) pages and must be printed single sided

- when printing, only the required certifications and signing panels appear

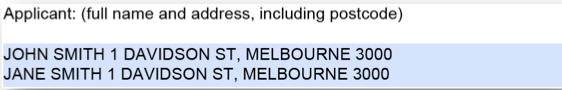

- when there are multiple parties in an Applicant panel, use the <return> key after each applicant/party. This will ensure a signing option will appear for each applicant/party. See example below:

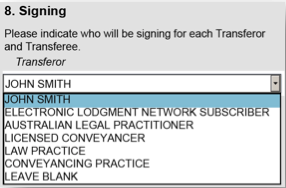

Making the appropriate signing selection

Representing a client

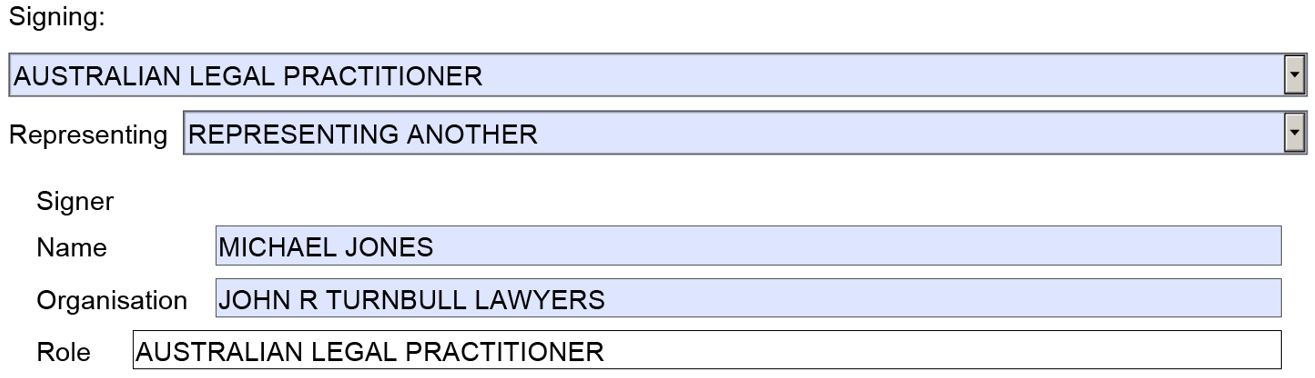

For conveyancers and lawyers representing a client, under ‘Signing’, the correct selections are: LICENSED CONVEYANCER/CONVEYANCING PRACTICE or AUSTRALIAN LEGAL PRACTITIONER, and then REPRESENTING ANOTHER.

After making the appropriate selection the certifications are automatically displayed.

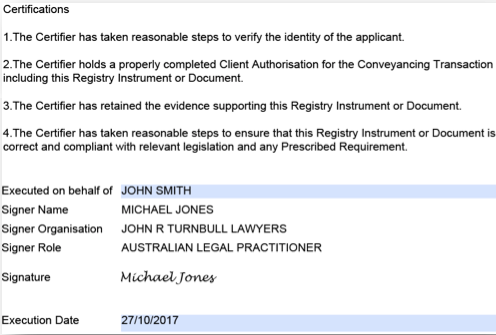

Below is a sample of the certifications when a lawyer represents a client in, for example, an application.

Note: the same certifications and signing structure is displayed when a conveyancer selects LICENSED CONVEYANCER/CONVEYANCING PRACTICE and REPRESENTING ANOTHER.

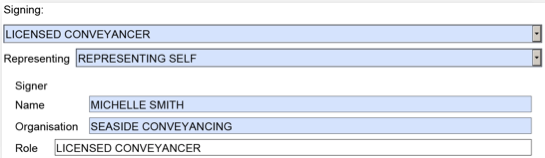

Self-representing (subscribers)

A conveyancer, lawyer or financial institution acting on their own behalf should select REPESENTING SELF.

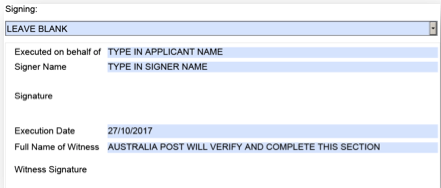

Non-represented party

For the Transfer of Land, Caveat and Withdrawal of Caveat forms a non-represented party will select their name from the drop-down list and the signing section will automatically populate. For all other forms select LEAVE BLANK and fill in each panel. The non-represented party must then proceed to Australia Post to do the Verification of Identity (VOI) process. More information on VOI is at www.propertyandlandtitles.vic.gov.au >Overview and instructions.

Example of Transfer of Land

Example of LEAVE BLANK selection

Entitlement to sign registry instruments

The Australian Registrars’ National Electronic Conveyancing Council (ARNECC) has published Entitlement to sign Registry Instruments, based on advice provided by practitioner regulators. The document is available at www.arnecc.gov.au/resources/guidance-practitioner-regulators.

For conveyancers in Victoria, Consumer Affairs Victoria has determined that a licensed conveyancer and a non-practitioner employee of a licensed conveyancer may execute an instrument on behalf of a client. In the drop-down list of signing options in paper forms, select either ‘LICENSED CONVEYANCER’ or ‘CONVEYANCING PRACTICE’.

For lawyers in Victoria, the Victorian Legal Services Board/Commissioner has determined that only an Australian Legal Practitioner (ALP) or a licensed conveyancer employed by an ALP can execute instruments on behalf of a client. A non-practitioner employee of an ALP cannot sign. In the drop-down list of signing options in paper forms, select ‘AUSTRALIAN LEGAL PRACTITIONER’ or ‘LICENSED CONVEYANCER’.

'LAW PRACTICE' is also included in the drop-down list of signing options because it is a national list. This is not relevant to Victoria; however, it may be an appropriate selection in some other Australian jurisdictions.

Contact us

For location and contact details, go to www.propertyandlandtitles.vic.gov.au/contact-us.

Page last updated: 09/11/23